Welcome to

Assyria in Panama

A Gated Sanctuary Amidst the Enchanting Landscapes of San Carlos.

Step into a world where luxury and nature coalesce.

Assyria in Panama offers more than homes; it provides a gateway to a life of elegance and serenity.

Nestled in the lush landscapes of San Carlos, our community is a testament to refined living.

Now Selling - Register Today! - Explore our 5-Year No-Interest Financing Plan

Did you know? Assyria in Panama is nestled in the charming district of San Carlos,

a hidden gem known for its stunning natural landscapes and rich cultural heritage. This idyllic location is just a short drive from the famous El Valle de Anton, renowned for having one of the only inhabited volcanic craters in the world! Imagine living in a place where extraordinary natural wonders meet modern comforts — that's the unique allure of Assyria in Panama.

Crafting Your

Dream in Panama

At Assyria, we don’t just build homes; we craft dreams.

Each corner of our community reflects a commitment to excellence and a deep respect for the environment.

From the architecture to the amenities, every detail is curated to enhance your living experience.

Assyria in Panama, where each home is a masterpiece of design, nestled within the serene and picturesque district of San Carlos. Our homes blend modern luxury with the timeless charm of Panama's rich landscapes. Just a stone's throw away, the vibrant El Valle de Anton offers a retreat into nature with its lush forests and unique geological features. At Assyria, you don't just buy a house; you embrace a lifestyle where every day is a celebration of nature's beauty and architectural elegance.

Our Models and Lots - Starting at $59,000

Discover the elegance of our model homes, each designed with a blend of modern sophistication and traditional charm. Explore our available land plots, starting at an affordable price, and envision the endless possibilities that await in your future home.

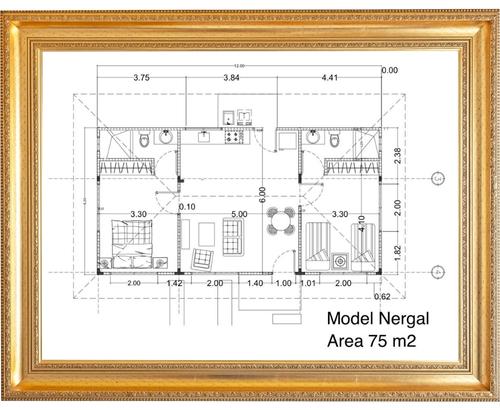

Model Nergal 75m2

Bask in the grandeur of spacious living, Assyrian-inspired aesthetics, and modern amenities.

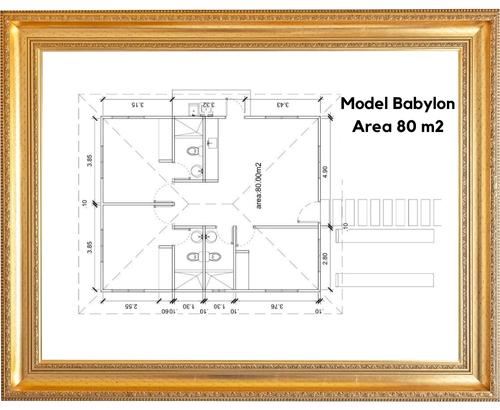

Model Babylon 80m2

Experience the fusion of tradition and innovation, set against the backdrop of San Carlos' natural splendor.

Lots for Sale 600m2

With a minimum size of 600 m², don't miss this opportunity to own land at an affordable price.

Meet Assyria

in Panama

Embark on a journey to a place where culture, luxury, and nature converge—Assyria in Panama. Here, within the District of San Carlos, we've woven a 20-acre tapestry of life, luxury, and legacy, inspired by the rich heritage of Assyria. Our meticulously designed community is an ode to quality living, offering 77 homes where spaciousness and natural light elevate each moment.

With land starting at just US$59,900 for a minimum size of 600 m², this presents an unparalleled opportunity to own desirable land at an affordable price point. Don't miss out on the chance to build your dream home in this enchanting paradise.

FREQUENTLY ASKED QUESTIONS

The project is located in El Espino, just 3.5 km from the entrance of El Valle, heading toward El Valle.

Lot sizes start from 600 m² with the cost of the lot at $59,000. We also offer a house of 72 m² with 2 bedrooms and 2 baths for a total of $160,000.

Yes, we have held the title for the last 10 years and received approval for the project 2 years ago. If you'd like to get a PDF of the documents, please fill out the form and we'll send them to you.

Yes, we have held the title for the last 10 years and received approval for the project 2 years ago. If you'd like to get a PDF of the documents, please fill out the form and we'll send them to you.

The project includes water, electricity, streetlights, a well water backup plan, green areas with a playground, separate septic tanks for each house, a social area with a swimming pool and tennis court, and a hotel with a restaurant and 20 suites.

We are currently in phase one, building up to ten model homes. Phase two, which includes developing the social area and parks, is targeted for completion by April 2025. Phase three involves building a hotel to attract attention to Assyria. We plan to have 5 model homes within 6 months.

There are no restrictions on construction or design, but any new designs need approval from authorities. All homes must have white exterior paint and a fiber glass clay-look roof in clay color, as per the master plan.

If you'd like to come and visit the Assyria Project. You can call us at (phone number here), or schedule a visit using our online booking system.

Book My Tour

We are offering low prices to attract residents initially. We believe that in 5 years, house prices could double. These homes are perfect for income-producing properties like Airbnb, Booking.com, VRBO, and Expedia. El Valle is known for its affluent community and weekend houses, and the project is just a 15-minute drive from quiet beaches.

The process is simple:

- Pick your lot from the master plan.

- For cash purchases, receive the title upon completion of the transaction.

- For builder financing, sign a contract with a promissory note. The title will be transferred once the lot is fully paid through the 60 months payment plan, which is interest-free and without extra costs.

Embrace the Elegance - Join Our Mailing List!